How Clark Wealth Partners can Save You Time, Stress, and Money.

Wiki Article

Clark Wealth Partners Fundamentals Explained

Table of ContentsThe Best Strategy To Use For Clark Wealth PartnersOur Clark Wealth Partners DiariesClark Wealth Partners Can Be Fun For EveryoneThe Main Principles Of Clark Wealth Partners Clark Wealth Partners Things To Know Before You BuyHow Clark Wealth Partners can Save You Time, Stress, and Money.Some Known Facts About Clark Wealth Partners.

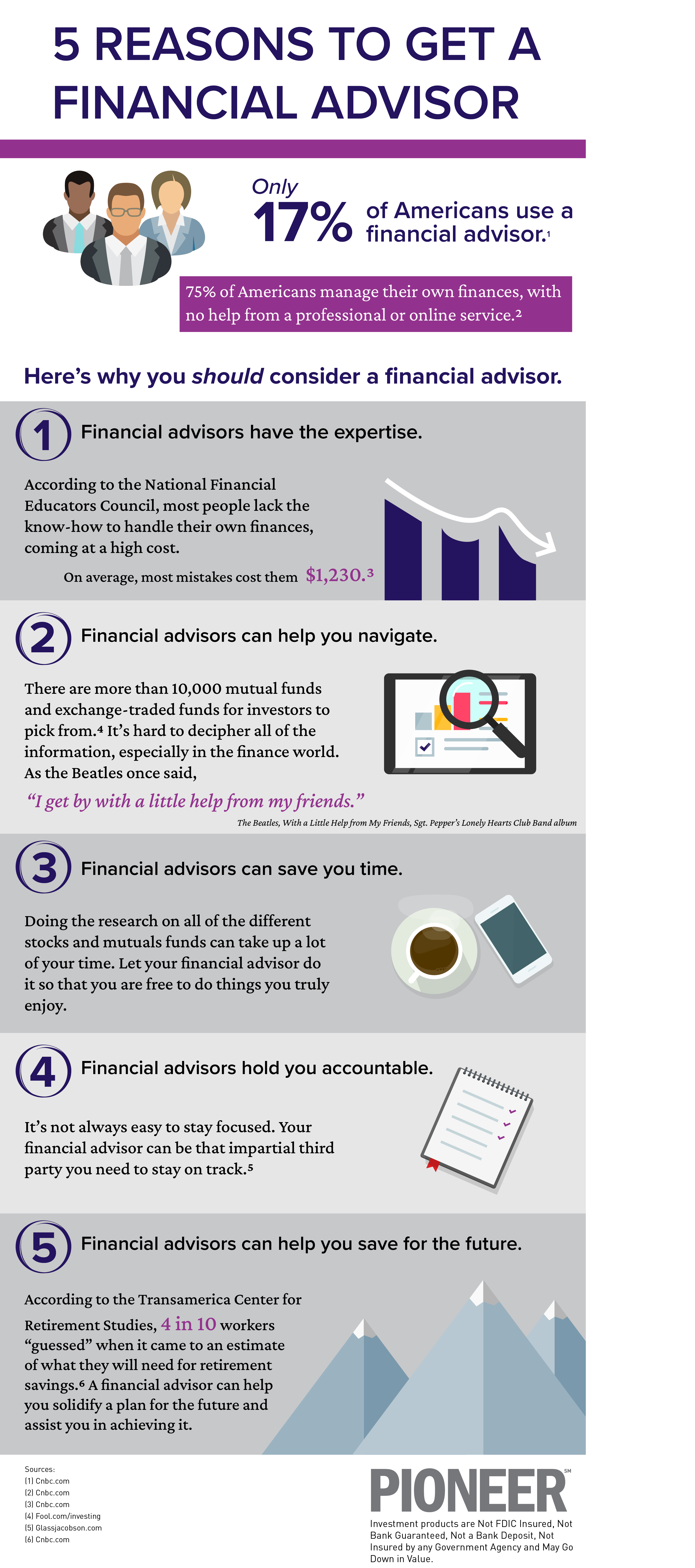

These are professionals who give financial investment guidance and are registered with the SEC or their state's safety and securities regulator. Financial advisors can also specialize, such as in trainee finances, elderly requirements, taxes, insurance and various other elements of your funds.Just monetary consultants whose designation calls for a fiduciary dutylike certified economic coordinators, for instancecan state the exact same. This difference likewise implies that fiduciary and monetary advisor cost frameworks differ too.

Our Clark Wealth Partners Ideas

If they are fee-only, they're much more likely to be a fiduciary. If they're commission-only or fee-based (indicating they're paid using a mix of fees and payments), they could not be. Many credentials and classifications call for a fiduciary duty. You can inspect to see if the expert is registered with the SEC.

Selecting a fiduciary will certainly guarantee you aren't guided towards specific financial investments because of the commission they provide - financial advisor st. louis. With great deals of cash on the line, you might desire a financial professional who is legitimately bound to make use of those funds carefully and just in your finest rate of interests. Non-fiduciaries may recommend investment items that are best for their wallets and not your investing objectives

How Clark Wealth Partners can Save You Time, Stress, and Money.

Find out more now on how to keep your life and savings in equilibrium. Boost in financial savings the typical household saw that collaborated with a monetary advisor for 15 years or more contrasted to a similar family without an economic advisor. Resource: Claude Montmarquette & Alexandre Prud'homme, 2020. "Much more on the Worth of Financial Advisors," CIRANO Job News 2020rp-04, CIRANO.

Financial recommendations can be beneficial at transforming points in your life. When you meet with an adviser for the first time, work out what you desire to obtain from the advice.

The Single Strategy To Use For Clark Wealth Partners

When you have actually concurred to go in advance, your financial adviser will certainly prepare a monetary plan for you. This is offered to you at another meeting in a document called a Declaration of Guidance (SOA). Ask the advisor to discuss anything you don't recognize. You must always feel comfortable with your consultant and their recommendations.Firmly insist that you are informed of all purchases, which you receive all correspondence pertaining to the account. Your adviser might suggest a managed optional account (MDA) as a method of handling your investments. This involves authorizing an arrangement (MDA contract) so they can buy or market investments without needing to talk to you.

The Single Strategy To Use For Clark Wealth Partners

To protect your cash: Do not give your consultant power of attorney. Firmly insist all document about your financial investments are sent to you, not just your adviser.This may occur during the conference or digitally. When you get in or restore the ongoing cost setup with your consultant, they must explain exactly how to end your relationship with them. If you're relocating to a brand-new adviser, you'll need to organize to move your financial records to them. If you require assistance, ask your consultant to clarify the process.

To load their footwear, the country will require more than 100,000 read what he said brand-new monetary experts to enter the sector.

The Buzz on Clark Wealth Partners

Aiding people accomplish their monetary objectives is an economic expert's primary function. They are additionally a tiny organization proprietor, and a section of their time is dedicated to handling their branch workplace. As the leader of their technique, Edward Jones economic consultants require the management abilities to work with and manage staff, along with business acumen to produce and perform an organization strategy.Investing is not a "set it and forget it" task.

Financial advisors ought to arrange time weekly to fulfill new people and catch up with individuals in their round. The monetary services sector is heavily controlled, and guidelines change typically - https://site-nq446ewsn.godaddysites.com/f/why-choosing-the-right-financial-advisors-illinois-transforms-you. Many independent monetary consultants invest one to 2 hours a day on conformity activities. Edward Jones financial advisors are lucky the office does the heavy lifting for them.

The Greatest Guide To Clark Wealth Partners

Edward Jones monetary advisors are urged to seek additional training to expand their expertise and skills. It's also an excellent concept for economic consultants to participate in market seminars.Report this wiki page